Create a Thrift Savings Plan portfolio starting with C Fund

The Thrift Saving Plan C Fund, or Common Stock index fund, is an investment fund available to federal employees with an objective to match the performance of the S&P 500 Index. The C Fund, like the S&P 500 index, covers a broad U.S. stock market index made up of 500 large and medium-sized U.S companies.

The Federal Retirement Thrift Investment Board administers the Federal Government Thrift Savings Plan and has chosen both BlackRock Institutional Trust company and State Street Global Advisors as the current asset managers for the C Fund, S Fund, F Fund and I Fund.

To track the performance of the C Fund investors can use any of these publicly available indexes or ETFs which have a very high correlation with the C Fund.

| Thrift Saving Plan C Fund Ticker options |

|---|

| ^GSPC – S&P 500 Index on Yahoo.com |

| SPY – SPDR S&P 500 ETF Trust |

| VOO – Vanguard S&P 500 ETF |

| IVV – iShares Core S&P 500 ETF |

| SWPPX – Schwab S&P 500 Index Fund |

| FUSEX – Fidelity Spartan 500 Index Investors Shares |

Why invest in the C Fund?

TSP participants who invest in the C Fund have the opportunity to gain from owning a broad-range of U.S. company stocks. These investors will experience movement up and down in their investment along with the prices of the stock in the index. The volatility from these price changes is reduced by investing in a diversified cross section of the entire U.S. economy.

Track C Fund performance

Because TSP funds are not offered in the public market, publicly traded low-cost ETFs and mutual funds for the S&P 500 index can be used to approximate C Fund performance.

Like the S&P 500 index, the C Fund covers a broad market index made up of stock of 500 of the largest U.S. companies and medium-sized U.S. companies.

Both BlackRock Institutional Trust company and State Street Global Advisors are the current asset managers for the C Fund, S Fund, F Fund and I Fund.

Most employees of the U.S. Federal government are eligible to participate in the TSP. To see if you qualify, see further details on the official TSP website.

Comparison to other TSP equity, bond, and lifestyle funds

In addition to the C Fund, the Thrift saving plan consists of four other core TSP funds that invest in broad equity and bond markets as well as ten lifestyle funds that as a whole offer TSP investors a wide range of options for their retirement accounts.

Of the three equity or stock funds available in the TSP, the C Fund is the most conservative. However, it has generated higher returns than both the bond fund (F Fund) and even more secure Government investment (G Fund) guaranteed by the U.S. Government.

| TSP Fund | TSP Fund equivalent ticker symbol | Description |

|---|---|---|

| C Fund | SPY | Common Stock Index Investment Fund |

| S Fund | VXF | Small-Cap Stock Index Investment Fund |

| I Fund | EFA | International Stock Index Investment Fund |

| F Fund | AGG | Fixed Income Index Investment Fund |

| G Fund | BIL or Cash | Government Securities Investment Fund |

F Fund: Fixed-Income Investment Index Fund

The F Fund invests in a wide range of debt instruments, including publicly traded government bonds, corporate and foreign bonds, and mortgage-backed securities (MBS). Like other publicly available bond funds, this bond fund pays a monthly interest payment, but does not guarantee return of the investor’s principal.

G Fund: Government Securities Investment Fund

The G Fund does not follow an index and invests in special non-marketable treasury securities created specifically for the TSP by the U.S. government. The G fund is guaranteed by the U.S. Government, so there is no risk of loss, and it earns interest at a rate determined by the U.S. Treasury at a yield equivalent to short-term U.S. Treasury securities. It has the lowest risk of all the TSP core funds and is the default fund for TSP investors.

S Fund: Small-Capitalization Stock Index Fund

The S Fund holds the same securities as the Dow Jones U.S. Completion Total Stock Market Index. It contains 4,500 companies outside of the Standard & Poor’s 500 Index. When combined, the C Fund and S fund make up the companies that make up the very broad Wilshire 5000 Index. The companies in the S Fund are smaller than those in the C Fund (S&P 500 index) and so The S Fund tends to have higher volatility and has historically outperformed the C Fund.

I Fund: International Stock Index Investment Fund

The I Fund invests in international stocks based outside of the United States. It replicates the Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index and consists of larger, more established companies located in developed countries around the world.

L Funds: Lifecycle Funds

TSP Lifecyle funds let investors with TSP accounts invest in a single TSP fund containing a combination of the five core funds. Each L Fund holds core TSP funds in a ratio determined by professionals to give the best expected return for the amount of expected risk appropriate for the year in which future funds will be needed.

TSP Lifecycle Funds are designed to simplify the investment decision by letting investors choose only one TSP fund designed for when they will retire from government service and need access to their TSP funds.

There are ten L Funds available today with retirement dates between 2025 and 2065, in five year increments.

Every 90 days each L Fund automatically adjusts holdings of the core funds to shift funds from high risk and reward to lower risk and reward as the target date gets closer.

When the target date is reached, the L Fund is rolled into the L Income fund, which is designed for an investor who has reached their target date and may need access to their TSP funds.

TSP Lifecycle funds

- L Income

- L 2025

- L 2030

- L 2035

- L 2040

- L 2045

- L 2050

- L 2055

- L 2060

- L 2065

Adding C Fund to your investment portfolio

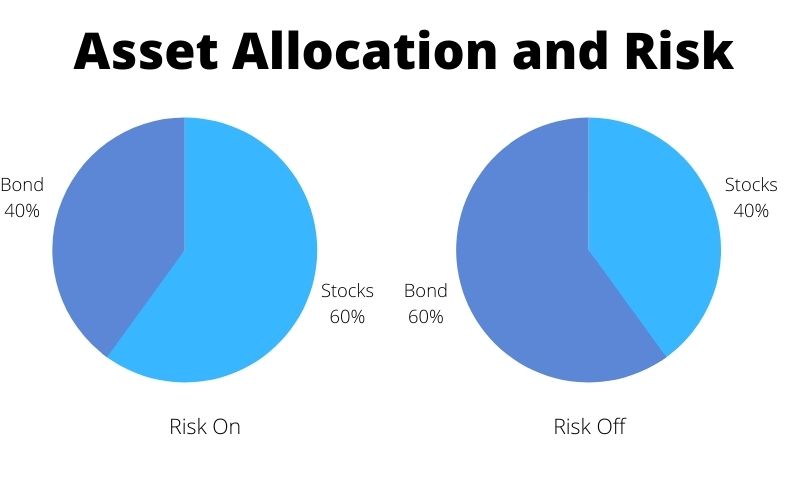

A common type of investment strategy referred to as a Strategic asset allocation is where an investor sets target allocations for various asset classes and rebalances the portfolio periodically. The target allocations are based on factors such as the investor’s risk tolerance, time horizon, and investment objectives.

The C Fund can be added to your portfolio to satisfy the need for investing in stocks of companies. In addition to holding the C Fund, investors may choose to hold other funds that invest in international stock markets such as the I Fund or the S Fund which invests in smaller companies in the U.S.

To balance stock holdings, bonds are often added to a portfolio because they are considered safer investments than stocks, but generally have lower returns.

Historically bond index funds have had an inverse correlation to stock index funds, meaning when stocks go up, bonds tend to go down. This can help to reduce volatility in an investor’s portfolio.

Strategic investment portfolios with different asset allocations

| Type of portfolio | Stock Fund percentage | Bond Fund percentage |

|---|---|---|

| Conservative | 30% | 70% |

| Moderate | 60% | 40% |

| Aggressive | 85% | 15% |

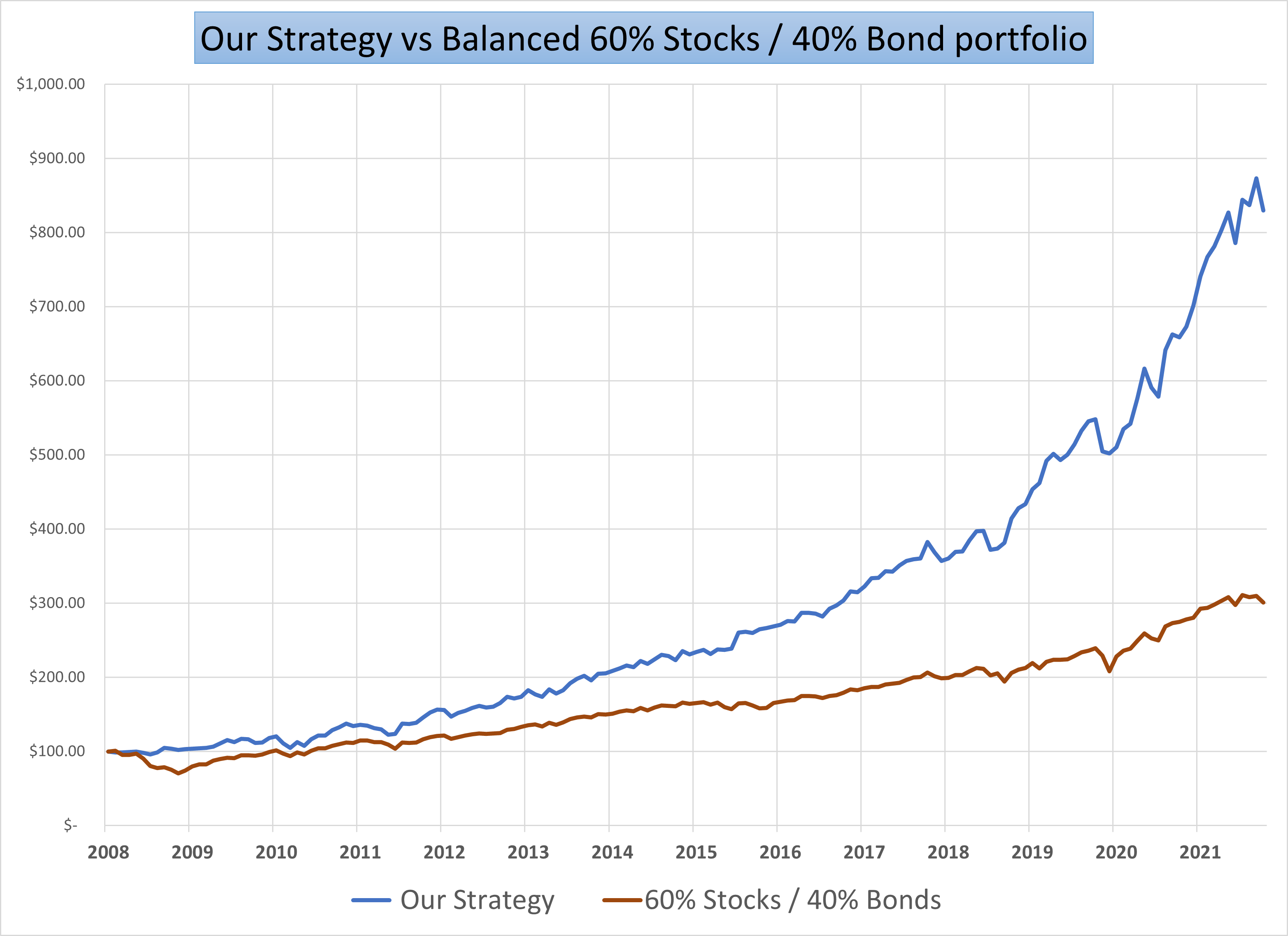

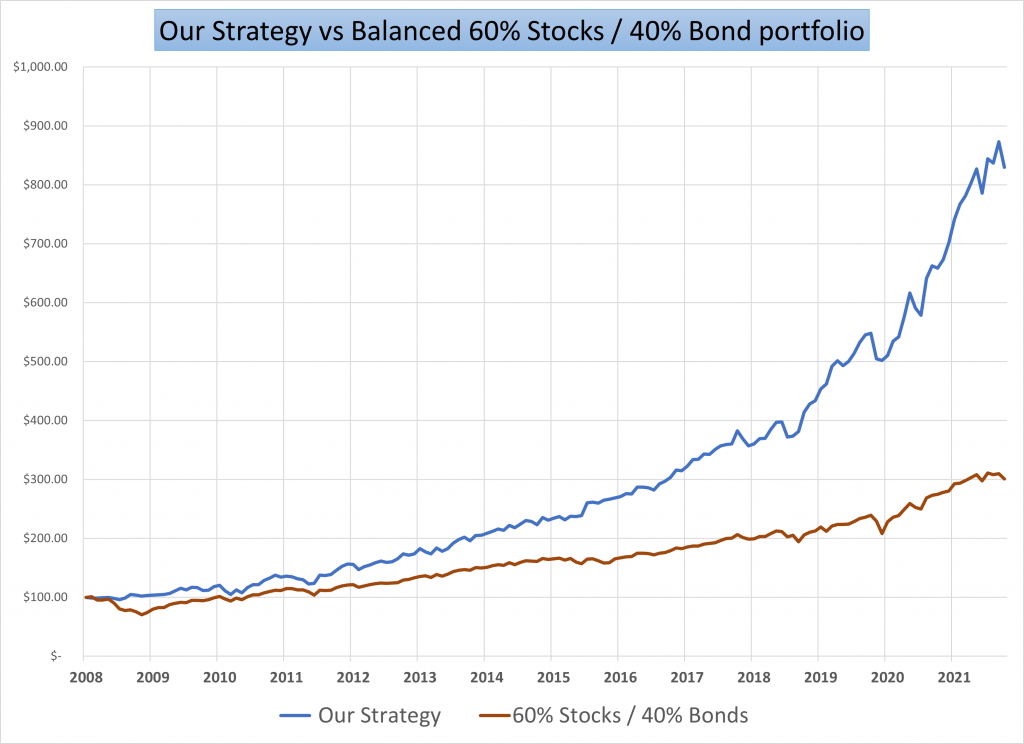

In addition to investing their TSP portfolio using a Strategic Asset Allocation (SAA) strategy, some investors chose to follow a Tactical Asset Allocation (TAA) strategy with all or some of their retirement savings.

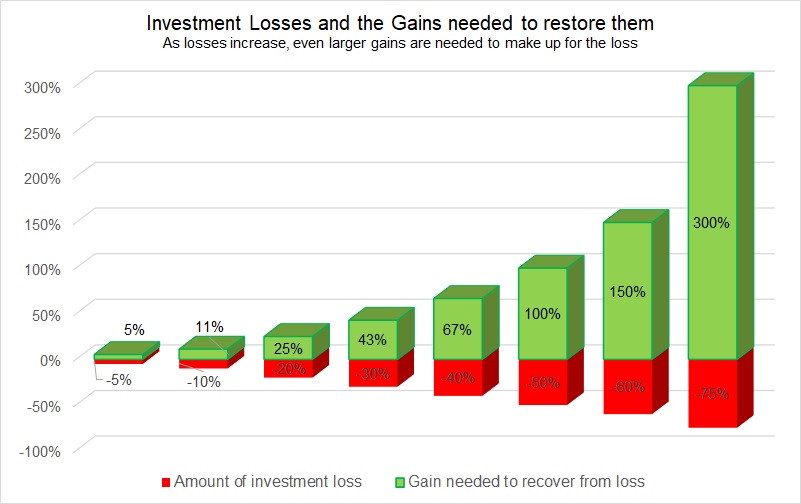

A Tactical Asset Allocation strategy differs from a SAA strategy in that at TAA actively adjusts core investment funds according to current economic conditions. The goals of most TAA strategies are to improve investment performance and to limit drawdowns and help ensure capital preservation when financial markets fall.

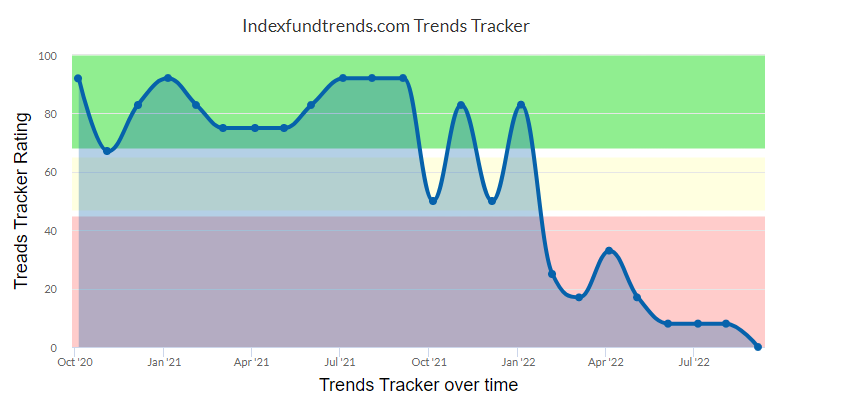

Indexfundtrends.com has an TAA investment strategy specifically designed for TSP account holders called the Dynamic TSP Strategy. It has been shown to perform better over the long run than a strategic asset allocation strategy with smaller drawdowns and good investment returns.

Get our FREE Strategy updates next month!

Sign-up today

Learn more about our Investment Strategies and view current recommendations

Click Here