Five asset allocation strategies to avoid a stock market crash

How do market crashes affect investment portfolios?

Stock market crashes can be devastating for individual investor investment portfolios.

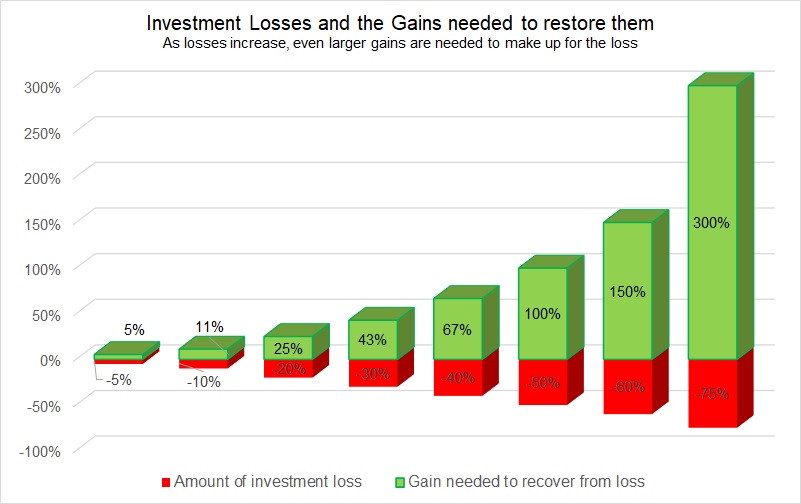

As can be seen in the chart below, as the loss from a stock market crash grows larger, the farther behind an investor becomes. The percentage gain required to get back to where they started grows at an even faster rate.

What is a Drawdown?

A drawdown is the loss or drop in value of an investment or account from a high or peak value until it recovers back to the same high.

Referred to as a percentage, two key elements must be considered:

- Time – how long will it take to recover from the loss

- Money – the dollar amount of the loss

Drawdowns are a vital factor that is often overlooked when evaluating different investment options. Unfortunately there is no requirement that they be reported to investors.

Investors nearing retirement may not have the luxury of time to recover from a large drawdown. If drawdowns can be minimized, then investments can continue growing sooner after a stock market crash.

Indexfundtrends.com reports drawdowns for all their strategies and also allows members to compare strategies with other investments.

Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.

Here are five strategies on indexfundtrend.com that all reduce portfolio drawdowns

1. Dynamic U.S. Market Strategy

This strategy invests in the S&P500 index, which comprises 500 of the largest U.S. publicly traded companies and represents approximately 80% of the overall U.S. stock market. An S&P500 index fund or like-fund is available in most investor accounts. This strategy, despite outperforming buy-and-hold investment portfolios, has had only a small number of trades per year, making it easy to follow.

The maximum drawdown for the Dynamic U.S. Market strategy is -13.0%.

Get our FREE Strategy updates next month!

Sign-up today

Learn more about our Investment Strategies and view current recommendations

Click Here

2. Dynamic TSP Strategy

The Dynamic TSP Strategy is designed to generate higher returns and minimize losses for employees of the U.S. Government who invest with Thrift Savings Accounts. Stock market performance is evaluated each month and determines the strongest performing funds at the time.

Investment fund recommendations are then made for the next month in the TSP account. Unlike traditional buy and hold (or static allocation) strategies, the Dynamic TSP Strategy can improve returns and minimize losses by increasing allocation to assets expected to outperform and reducing allocation to assets expected to underperform.

The maximum drawdown of the Dynamic TSP strategy is -15.1%.

3. 20 x 5 Strategy

The 20 by 5 Strategy is designed to gradually increase holdings in stocks as market momentum gets stronger. It increases and decreases holdings in 20 percent increments. Stock market performance is evaluated each month and determines the strongest performing funds at the time. Investment fund recommendations are then made for the next month. Unlike traditional buy and hold (or static allocation) strategies, the 20 by 5 Strategy can improve returns and minimize losses by increasing allocation to assets expected to outperform and reducing allocation to assets expected to underperform.

The maximum drawdown for the 20 by 5 Strategy is -16.7%.

4. Dynamic Sector Strength Strategy

This aggressive global momentum investment strategy is designed to invest most funds domestically in U.S. based investments including the S&P500 index, and NASDAQ 100 index (QQQ), heavily weighted in U.S. based technology companies, or internationally in either developed foreign markets and emerging markets. Up to 85% of funds can be invested in the index with the strongest recent performance.

In addition, up to 15% of funds can be invested in a less diversified sector index (described below), when that sector is performing strongly. The strategy will switch to the safety of government bonds or cash when performance of U.S or foreign markets turns down.

The maximum drawdown for the Global Dynamic Sector Strength Strategy is -19.7%.

5. Dynamic Technology Strategy

This aggressive global momentum investment strategy is designed to invest funds in U.S. based investments including the S&P500 index, and NASDAQ 100 index (QQQ), heavily weighted in U.S. based technology companies, or internationally in developed foreign markets and emerging markets. This is a particularly aggressive strategy in that it invests all the funds each month in the top performing index fund.

The strategy will switch to the safety of government bonds when performance of equity markets slows down.

The maximum drawdown for the Dynamic Technology Strategy is -15.1%.